Understanding payroll can be one of the most challenging aspects of running a business. With numerous deductions, taxes, and regulations to consider, it’s easy to feel overwhelmed. But what if there was a tool that could simplify this process? Enter the Payroll Deductions Online Calculator, an essential tool for businesses of all sizes. How can this tool transform your payroll management? Let’s dive in.

Understanding Payroll Deductions

Payroll deductions are amounts withheld from an employee’s gross pay. These deductions can include federal and state taxes, Social Security, Medicare, health insurance premiums, retirement contributions, and more. In addition to these common deductions, other variables like union dues or wage garnishments might also apply. Ensuring these deductions are accurately calculated is crucial for compliance, financial planning, and maintaining employee satisfaction. Properly managing these deductions helps avoid errors that could lead to legal complications or dissatisfaction among your workforce.

The Importance of Accurate Payroll Calculations

Accuracy in payroll calculations is non-negotiable. Incorrect deductions can lead to significant issues, including:

- Employee Dissatisfaction: Incorrect paychecks can lead to mistrust and decreased morale.

- Legal Consequences: Non-compliance with tax regulations can result in hefty fines and legal troubles.

- Financial Discrepancies: Miscalculations can affect your company’s financial health and reporting accuracy.

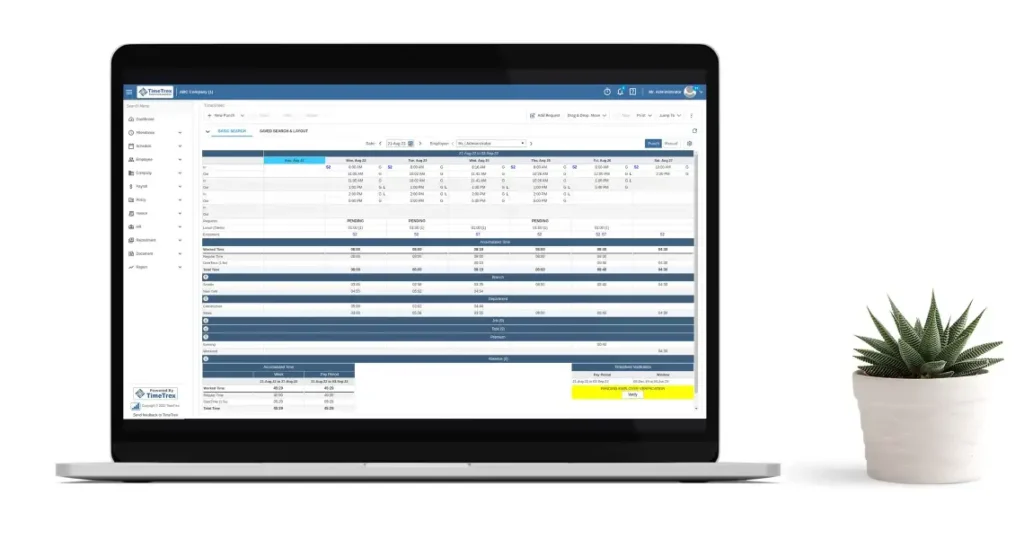

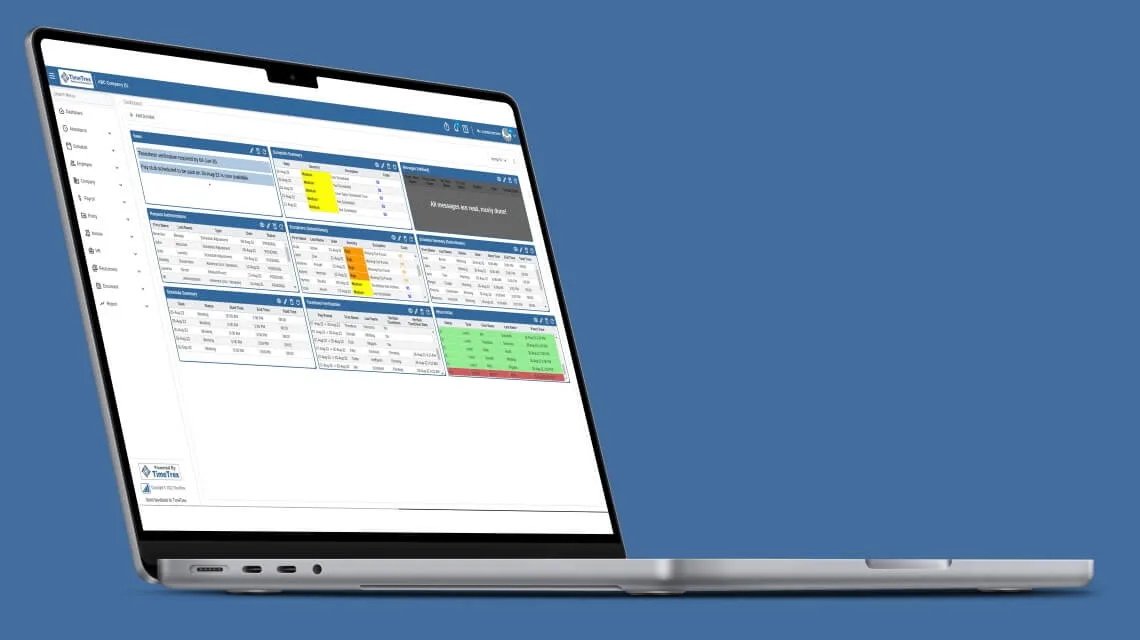

Introducing the Payroll Deductions Online Calculator

The Payroll Deductions Online Calculator is designed to take the guesswork out of payroll management. This tool allows businesses to:

- Calculate Deductions Quickly: With an intuitive interface, you can input employee data and receive accurate deduction calculations in seconds.

- Ensure Compliance: The calculator is updated with the latest tax laws and regulations, ensuring your payroll is always compliant.

- Save Time and Resources: Automating payroll calculations frees up time for other important business activities.

How to Use a Payroll Calculator Effectively

Using a payroll calculator is straightforward, but to maximize its benefits, consider the following steps:

1. Gather Employee Information

Ensure you have accurate and up-to-date information for each employee. This includes their gross pay, tax status, and any additional deductions. Additionally, gather details on overtime hours, bonuses, and any other compensation adjustments. Maintaining a comprehensive record of all payroll-related data helps ensure precise calculations and reduces the likelihood of errors in the payroll process.

2. Input Data Carefully

Enter the employee’s data into the calculator. Double-check for any errors, as incorrect information can lead to inaccurate calculations. Pay particular attention to details such as tax status, benefits elections, and any additional allowances or deductions. Thorough data verification ensures the calculator provides precise results, maintaining payroll accuracy and compliance.

3. Review and Verify Calculations

Once the calculator provides the deduction amounts, review them carefully. Verify against current tax rates and employee-specific deductions to ensure accuracy. It’s also a good practice to cross-check with historical payroll data to identify any discrepancies. Additionally, consulting with a payroll specialist can provide an extra layer of assurance and help address any complexities specific to your organization.

4. Integrate with Payroll Software

Many payroll calculators can integrate with your existing payroll software, streamlining the entire process. This integration ensures that all calculations are automatically reflected in your payroll system, reducing the need for manual data entry and minimizing errors. Additionally, seamless integration can improve overall efficiency, save time, and ensure that your payroll operations run smoothly and accurately, enhancing both productivity and employee satisfaction.

Benefits of Using an Online Payroll Calculator

1. Increased Accuracy

Automated calculations reduce the risk of human error, ensuring that all deductions are accurate and compliant with current laws.

2. Time Efficiency

Manual payroll calculations can be time-consuming. An online calculator significantly reduces the time needed to process payroll, allowing you to focus on other critical business tasks.

3. Cost Savings

By minimizing errors and ensuring compliance, businesses can avoid costly penalties and potential legal issues related to payroll discrepancies.

4. Employee Trust and Satisfaction

Accurate and timely paychecks foster trust and satisfaction among employees, contributing to a positive work environment.

Common Mistakes to Avoid

Even with a reliable tool like a payroll calculator, it’s essential to be aware of common mistakes that can occur:

- Ignoring Updates: Ensure your calculator is always updated with the latest tax laws and rates.

- Inaccurate Data Entry: Double-check all input data for accuracy.

- Overlooking Specific Deductions: Account for all employee-specific deductions, such as retirement contributions or health insurance premiums.

Conclusion: Streamlining Payroll with Confidence

In today’s fast-paced business environment, efficiency and accuracy are paramount. The Payroll Deductions Online Calculator is an invaluable tool for any business looking to streamline its payroll process. By reducing errors, saving time, and ensuring compliance, this tool can transform your payroll management. It not only simplifies complex calculations but also provides peace of mind, allowing you to focus on growing your business while maintaining flawless payroll practices.

Are you ready to take the guesswork out of payroll? Embrace the power of technology with the Payroll Deductions Online Calculator and experience the difference in your business operations.