Forex trading can be both thrilling and profitable, but picking the right trading platform is a vital step. It helps maximize your chance of profiting from your trading. A bad broker can turn you from a profitable trader to a trader that is losing money. For Canadian traders, finding a Canadian forex trading platform that meets your needs means considering several important factors. Here’s a detailed guide to help you make a smart choice.

Regulation is Key

The forex market can be full of pitfalls, so ensure your trading platform is regulated by the Investment Industry Regulatory Organization of Canada (IIROC) or another reputable regulatory body. An IIROC registered broker is always best for Canadian traders. Regulation ensures that the platform adheres to strict standards, providing a safety net for your investments.

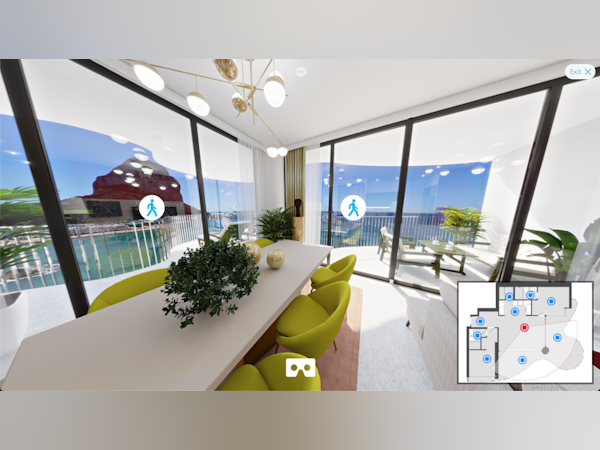

Platform Usability: Your Trading Workspace

Your trading platform should be fast, intuitive, and packed with the features you need. Popular choices like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are favored for their robustness and advanced analytical tools. Use the brokers free demo account to test the platform’s performance and user-friendliness before committing.

Watch Out for Fees and Spreads

Trading costs can sneak up on you if you’re not vigilant. Compare the spreads, commissions, and other fees across different platforms. Some platforms offer low spreads but have higher commissions, while others might offer zero commission trades but make up for it with wider spreads. Understanding these costs can help you keep more of your profits.

Customer Support: Your Backup

When trading forex, reliable support is crucial. Look for platforms that offer 24/7 customer service through multiple channels like phone, email, and live chat. Responsive and knowledgeable support can save you a lot of hassle, especially during market fluctuations.

Trading Tools and Resources

The right tools can significantly enhance your trading experience. Choose platforms that provide comprehensive analytical tools, real-time data, and educational resources. Webinars, tutorials, and market analysis reports are particularly valuable for beginner traders.

Account Types: Flexibility is Important

Different traders have different needs. Ensure the platform offers a variety of account types, such as standard accounts, mini accounts, and demo accounts. This flexibility allows you to choose an account that matches your trading volume, risk tolerance, and experience level.

Security Measures

Your personal and financial information should be well-protected. Look for platforms that offer advanced security measures such as two-factor authentication, encryption, and secure servers. A platform that prioritizes security will give you peace of mind while trading.

Payment Methods

Consider the deposit and withdrawal options available. The process should be straightforward, with multiple methods such as bank transfers, credit/debit cards, and e-wallets. Check for any associated fees and the processing time for transactions.

Reputation and Reviews

Research the platform’s reputation by reading reviews and testimonials from other traders. Reliable platforms will have positive feedback and transparent operations. Be cautious of platforms with numerous negative reviews or unresolved complaints. These are major red flags when choosing a forex broker.

Summary

Choosing the right forex trading platform in Canada requires thorough research and careful consideration of factors such as regulation, platform usability, fees, customer support, and available tools. By taking the time to evaluate your options, you can find a platform that not only meets your needs but also provides a secure and efficient trading environment. Happy trading!