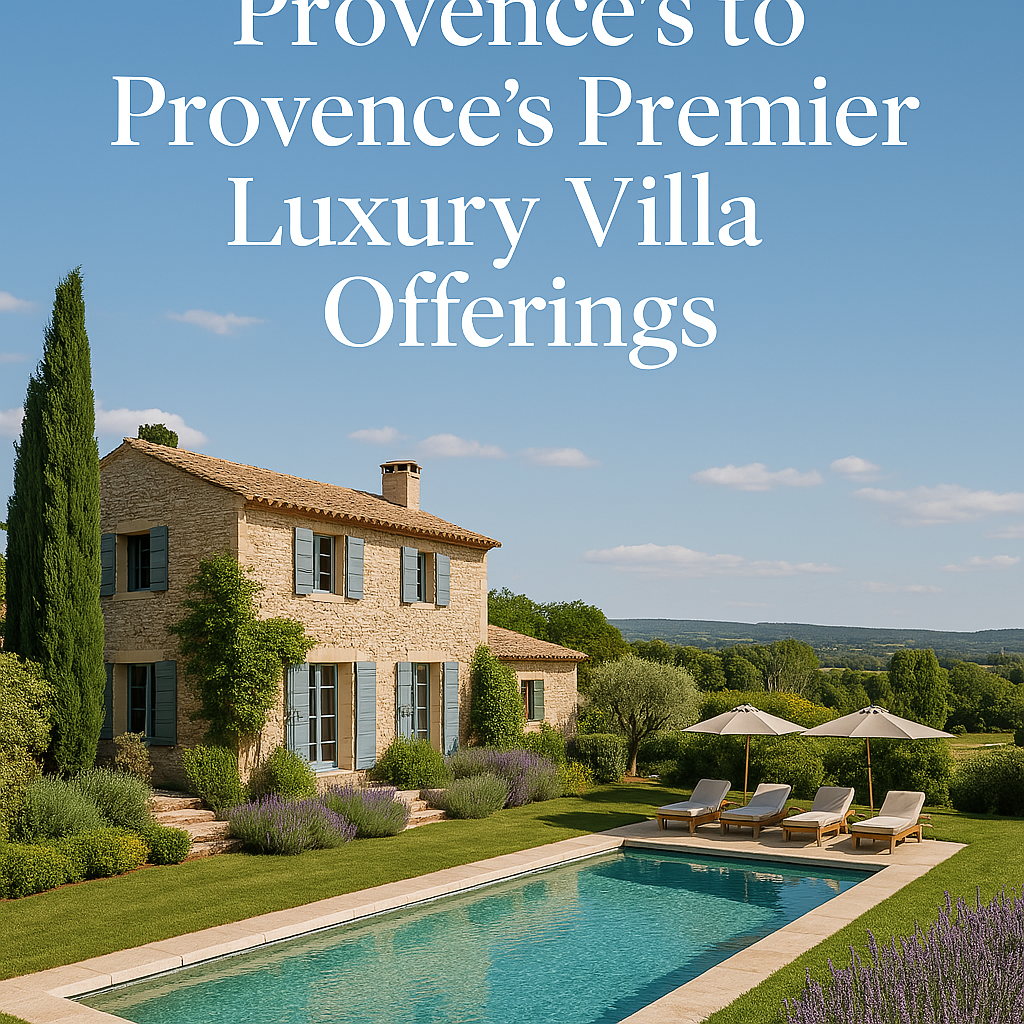

Image Source: Pexels

Tax audits can be exhausting. According to the Canada Review Agency (CRA), tax audits can take longer post-pandemic. A typical audit takes nearly a year (341 days) on average to complete, and that’s only for small businesses.

Auditing a larger company will probably take even longer. This can cause significant disruption to the business as authorities can review your financial records from several years back. The CRA often chooses files for audit based on risk assessment, looking at errors in tax returns and possible non-compliance. The CRA will look at their records, compare previous filings, and consider provided information before conducting further investigations.

A tax audit isn’t something you can plan. Even established businesses don’t know when the tax agent will strike. Therefore, it’s best to prepare for it and not wait until they come knocking on your door. Here’s how you can prepare for a CRA tax audit.

Confirm Tax Audit Years

When your business receives a tax audit notice, immediately connect with the CRA auditor assigned to your case. Ask about the tax audit years they plan to investigate. This will help you gather relevant information to make the tax audit process go faster.

In most cases, the CRA will investigate the past two years of tax filing. However, they can go four years back as they deem necessary. Remember, however, if they suspect fraud, they can go back an indefinite number of years.

Confirm which companies are up for audit if you own multiple businesses or manage different income streams. Only provide requested records. Providing them with exactly what they need helps streamline the process.

Ask For An Extension

If you think you need more time to prepare for the tax audit, don’t hesitate to ask for an extension. It will allow you to consult with your bookkeeper and gather information. This will also make it easier for the auditor to complete the investigation. However, you must give the auditor a good reason for the delay.

Be Cooperative

The CRA auditor will conduct their investigation in your place of business. It will help if you can provide them with a space where they can work. Having your bookkeeper present during the audit to answer questions the auditor may have can also expedite the process.

Make sure to provide all the information that the CRA auditor requires. However, direct your employees to direct all questions and requests from the auditor to you or your bookkeeper. You want to avoid giving the wrong information and minimize miscommunication.

Coordinate Required Changes

Ask for clarification if the CRA auditor reports that you must change your records after the audit. An explanation will give you an idea if you should accept or challenge the results. The CRA allows you to object if you disagree with the CRA’s reassessment.

Sit down with your tax professional and decide if challenging the results is worth it. If possible, discuss the required changes with the auditor before filing a reassessment notice.

Keep Complete Records

In tax audits, your best defence is to keep complete records and an excellent bookkeeping process. Hire a bookkeeper or tax preparer aware of the tax laws to ensure compliance. As a business owner, you must complete and maintain your tax records for just such an occasion.